Featured

Table of Contents

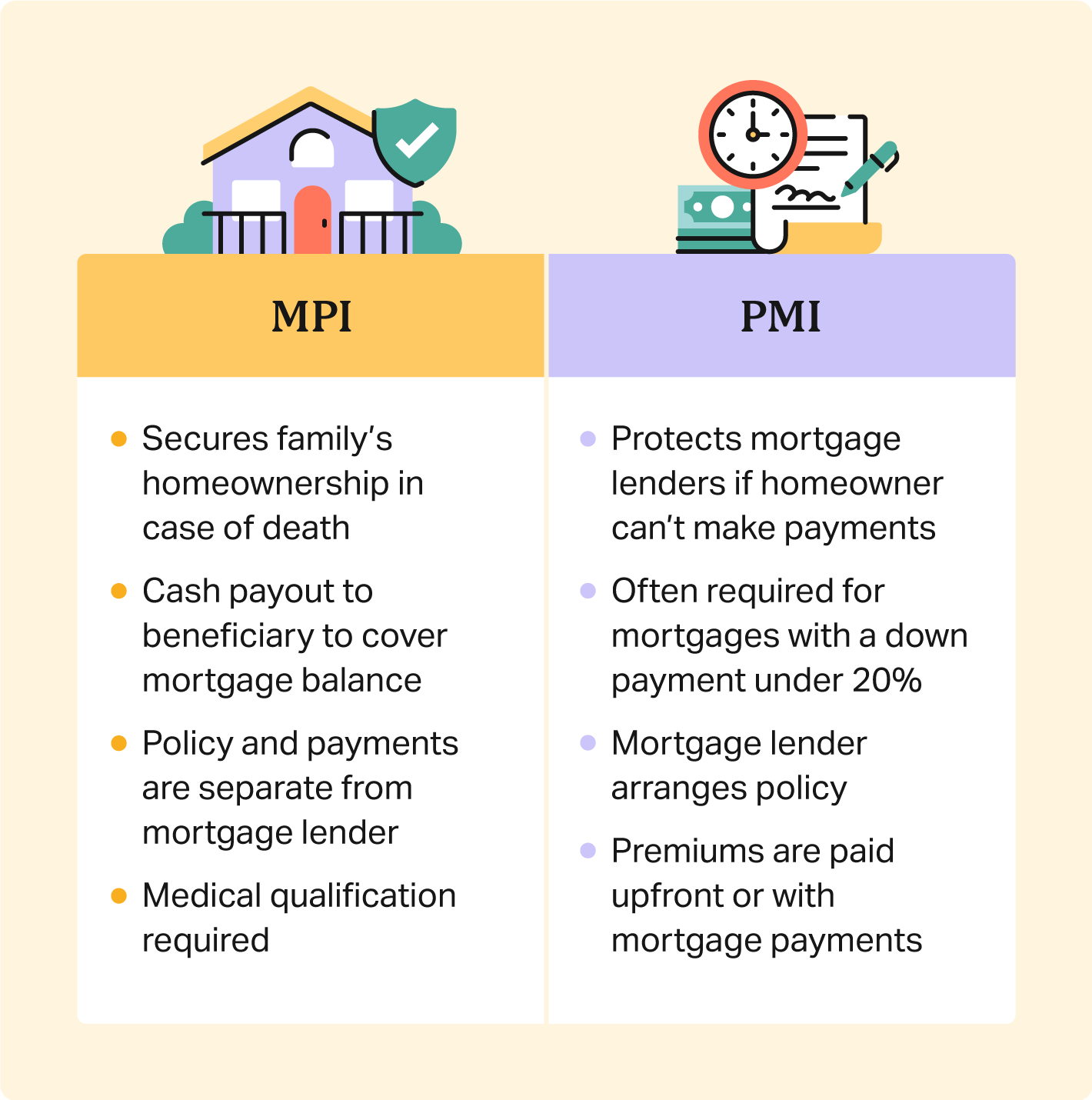

Nevertheless, keeping every one of these phrases and insurance coverage kinds directly can be a frustration - what is mortgage protection insurance uk. The complying with table positions them side-by-side so you can swiftly distinguish amongst them if you obtain perplexed. An additional insurance policy coverage type that can settle your home loan if you die is a typical life insurance policy plan

A is in location for a set number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away during that term. A provides protection for your whole life span and pays out when you pass away.

One usual guideline is to aim for a life insurance coverage plan that will certainly pay out approximately ten times the insurance holder's income amount. You could pick to utilize something like the Dollar technique, which adds a family members's debt, earnings, mortgage and education expenses to calculate exactly how much life insurance is required.

It's likewise worth keeping in mind that there are age-related restrictions and thresholds imposed by almost all insurance firms, who typically won't provide older purchasers as many options, will bill them much more or may refute them outright.

Below's exactly how home loan security insurance policy gauges up versus typical life insurance policy. If you're able to certify for term life insurance policy, you need to stay clear of home mortgage security insurance coverage (MPI).

In those scenarios, MPI can give fantastic peace of mind. Every home mortgage security option will have many guidelines, guidelines, benefit choices and disadvantages that require to be evaluated very carefully versus your exact situation.

Mortgage Protection Center Complaints

A life insurance plan can aid repay your home's home mortgage if you were to pass away. It's one of numerous manner ins which life insurance coverage might help protect your enjoyed ones and their monetary future. One of the very best ways to factor your home loan into your life insurance coverage need is to speak with your insurance policy representative.

Instead of a one-size-fits-all life insurance policy plan, American Domesticity Insurer offers plans that can be developed especially to fulfill your family members's demands. Below are a few of your alternatives: A term life insurance coverage plan. decreasing term mortgage life insurance is active for a specific quantity of time and generally provides a bigger quantity of insurance coverage at a reduced rate than an irreversible policy

Rather than only covering an established number of years, it can cover you for your whole life. It likewise has living advantages, such as money worth buildup. * American Household Life Insurance policy Business supplies different life insurance policy plans.

They might also be able to aid you discover gaps in your life insurance policy protection or brand-new ways to conserve on your various other insurance coverage plans. A life insurance recipient can select to utilize the fatality advantage for anything.

Life insurance policy is one means of assisting your household in repaying a home loan if you were to die before the home loan is entirely settled. No. Life insurance coverage is not compulsory, yet it can be a crucial part of assisting make certain your liked ones are monetarily shielded. Life insurance coverage earnings may be made use of to help settle a home loan, however it is not the exact same as home mortgage insurance coverage that you may be called for to have as a condition of a funding.

House Loan Insurance Policy

Life insurance policy might assist ensure your home remains in your household by providing a death advantage that might help pay down a home loan or make essential purchases if you were to pass away. This is a short summary of coverage and is subject to policy and/or cyclist terms and conditions, which might vary by state.

The words life time, long-lasting and long-term are subject to plan terms. * Any lendings drawn from your life insurance coverage policy will accumulate passion. home insurance and mortgage protection. Any type of superior financing equilibrium (loan plus interest) will be deducted from the survivor benefit at the time of insurance claim or from the money worth at the time of surrender

** Based on policy terms. ***Discounts might vary by state and company financing the vehicle or home owners plan. Discount rates might not relate to all protections on a vehicle or house owners plan. Discount rates do not apply to the life policy. Plan Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage protection insurance policy (MPI) is a various kind of safeguard that can be handy if you're unable to settle your home loan. Home mortgage security insurance is an insurance policy that pays off the remainder of your home mortgage if you pass away or if you come to be handicapped and can not function.

Both PMI and MIP are called for insurance coverages. The quantity you'll pay for mortgage protection insurance depends on a range of factors, consisting of the insurer and the current equilibrium of your home loan.

Still, there are advantages and disadvantages: Most MPI plans are provided on a "ensured approval" basis. That can be useful if you have a health and wellness problem and pay high prices forever insurance policy or battle to obtain protection. protection for life. An MPI plan can provide you and your family with a complacency

Mortgage Insurance Uk

It can additionally be valuable for individuals who do not receive or can't pay for a typical life insurance coverage plan. You can choose whether you require home loan security insurance coverage and for the length of time you need it. The terms normally vary from 10 to 30 years. You might want your mortgage defense insurance term to be enclose size to how much time you have actually delegated pay off your home loan You can terminate a home mortgage security insurance coverage.

Latest Posts

Seniors Funeral Insurance

Insurance Policy To Cover Funeral Costs

Difference Between Life Insurance And Funeral Insurance