Featured

Table of Contents

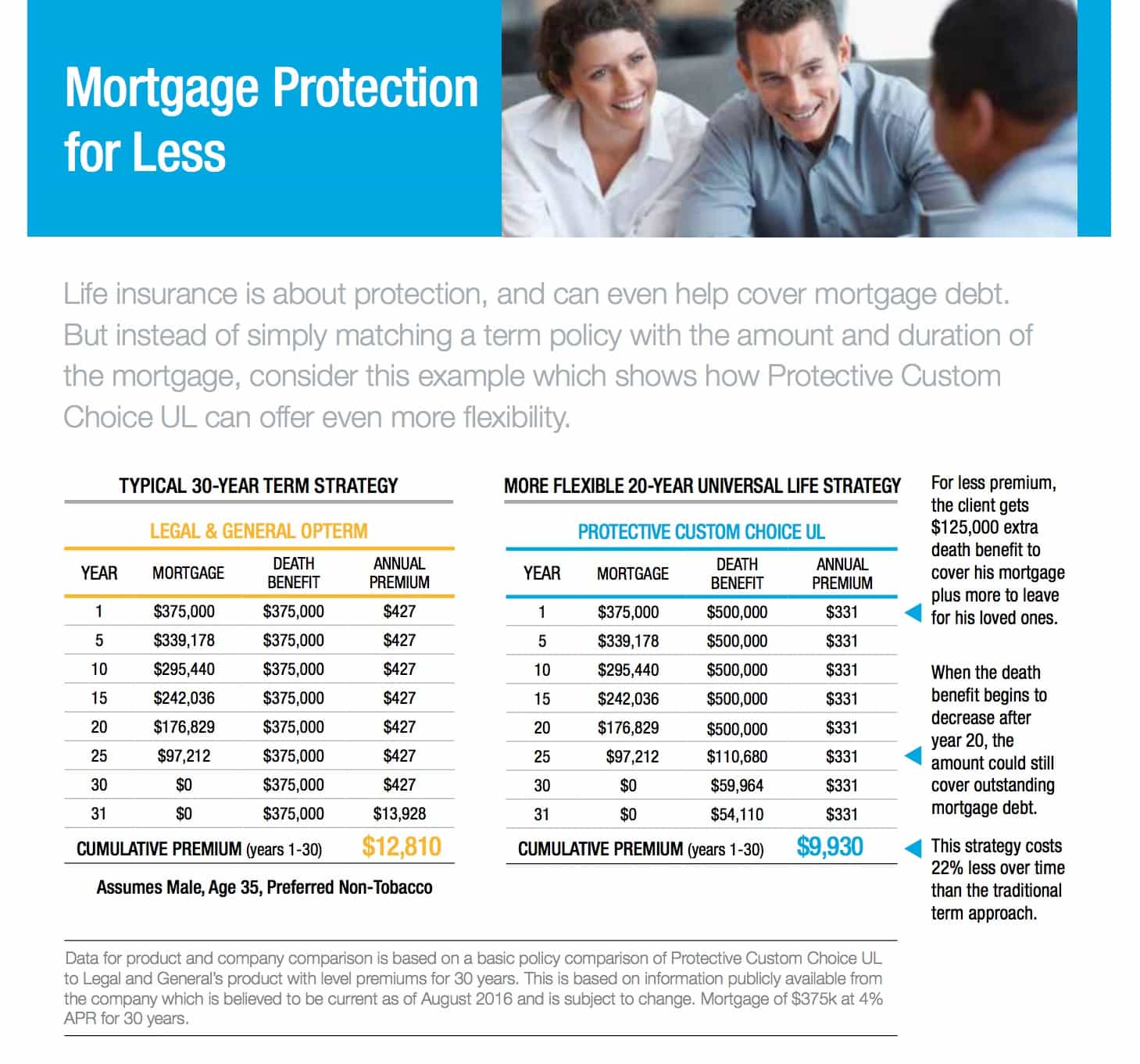

Maintaining all of these acronyms and insurance kinds straight can be a frustration. The adhering to table puts them side-by-side so you can promptly differentiate among them if you get confused. One more insurance protection kind that can repay your mortgage if you die is a conventional life insurance policy policy

A is in area for an established number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away throughout that term. An offers coverage for your whole life period and pays out when you pass away.

One usual rule of thumb is to go for a life insurance coverage policy that will certainly pay approximately 10 times the insurance policy holder's wage quantity. Alternatively, you could choose to make use of something like the DIME approach, which adds a household's debt, income, home loan and education expenditures to determine how much life insurance policy is required (self assurance mortgage policy).

It's additionally worth keeping in mind that there are age-related limitations and limits enforced by almost all insurance firms, that usually will not offer older buyers as numerous alternatives, will certainly bill them more or may deny them outright.

Here's just how home mortgage defense insurance coverage gauges up against basic life insurance policy. If you're able to qualify for term life insurance, you must stay clear of home mortgage defense insurance coverage (MPI).

In those circumstances, MPI can supply fantastic peace of mind. Every home loan security choice will certainly have various guidelines, regulations, benefit alternatives and drawbacks that need to be evaluated thoroughly against your specific situation.

Mortgage Insurance Unemployment Protection

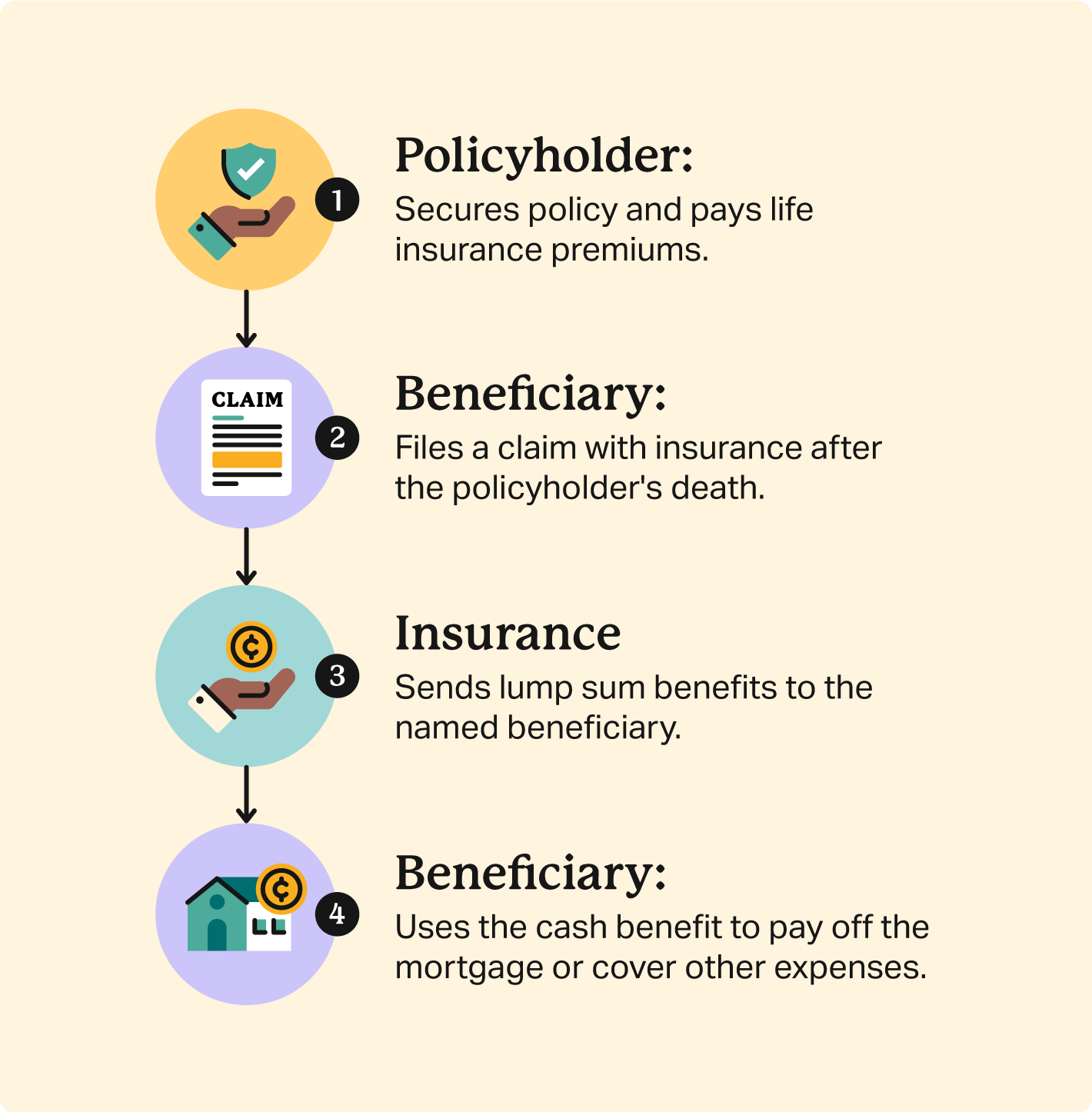

A life insurance coverage policy can assist settle your home's home mortgage if you were to pass away. It is just one of lots of manner ins which life insurance policy might aid secure your liked ones and their financial future. Among the very best means to factor your mortgage into your life insurance policy demand is to talk with your insurance agent.

Rather than a one-size-fits-all life insurance policy policy, American Family members Life Insurance coverage Business supplies policies that can be made especially to meet your family members's requirements. Below are a few of your alternatives: A term life insurance policy plan. mandatory mortgage insurance is energetic for a particular quantity of time and commonly provides a larger quantity of insurance coverage at a reduced rate than a long-term policy

Instead than only covering an established number of years, it can cover you for your entire life. It additionally has living benefits, such as money worth accumulation. * American Family Life Insurance policy Company offers different life insurance policies.

Your representative is a wonderful source to answer your concerns. They may also have the ability to aid you locate gaps in your life insurance coverage or brand-new methods to reduce your other insurance coverage plans. ***Yes. A life insurance policy recipient can select to utilize the fatality advantage for anything - who provides mortgage insurance. It's an excellent means to assist secure the financial future of your family if you were to pass away.

Life insurance coverage is one way of helping your household in paying off a home loan if you were to pass away prior to the home loan is totally repaid. Life insurance policy profits might be used to aid pay off a home loan, however it is not the exact same as home mortgage insurance coverage that you could be needed to have as a condition of a funding.

Mortgage Protection Plan Insurance

Life insurance may assist ensure your house remains in your family by offering a fatality benefit that might assist pay down a mortgage or make crucial purchases if you were to pass away. This is a brief summary of insurance coverage and is subject to policy and/or biker terms and conditions, which may vary by state.

The words life time, lifelong and permanent undergo policy terms. * Any loans extracted from your life insurance policy plan will accrue interest. mortgage insurance basics. Any kind of outstanding finance equilibrium (car loan plus passion) will be subtracted from the survivor benefit at the time of case or from the money value at the time of surrender

** Based on policy terms and conditions. ***Discount rates may differ by state and business financing the vehicle or house owners plan. Price cuts may not relate to all protections on an automobile or home owners plan. Discounts do not put on the life plan. Policy Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage security insurance policy (MPI) is a various type of safeguard that could be valuable if you're incapable to settle your home mortgage. Home mortgage security insurance policy is an insurance coverage policy that pays off the rest of your mortgage if you pass away or if you become handicapped and can't function.

Like PMI, MIP shields the lending institution, not you. Unlike PMI, you'll pay MIP for the duration of the finance term. Both PMI and MIP are required insurance protections. An MPI policy is totally optional. The amount you'll pay for mortgage defense insurance coverage relies on a selection of factors, consisting of the insurance company and the current equilibrium of your mortgage.

Still, there are benefits and drawbacks: The majority of MPI policies are released on a "guaranteed acceptance" basis. That can be advantageous if you have a health problem and pay high rates for life insurance policy or battle to acquire protection. mortgage protection vs life insurance. An MPI policy can supply you and your household with a complacency

Life Policy For Mortgage

You can choose whether you require home mortgage defense insurance coverage and for how long you need it. You could want your home mortgage security insurance policy term to be close in size to exactly how long you have actually left to pay off your home loan You can cancel a home mortgage defense insurance plan.

Latest Posts

Seniors Funeral Insurance

Insurance Policy To Cover Funeral Costs

Difference Between Life Insurance And Funeral Insurance