Featured

Table of Contents

A degree term life insurance coverage policy can provide you assurance that individuals that depend upon you will certainly have a survivor benefit during the years that you are intending to sustain them. It's a way to assist deal with them in the future, today. A degree term life insurance coverage (in some cases called level premium term life insurance coverage) policy gives protection for a set variety of years (e.g., 10 or two decades) while maintaining the premium settlements the exact same throughout of the plan.

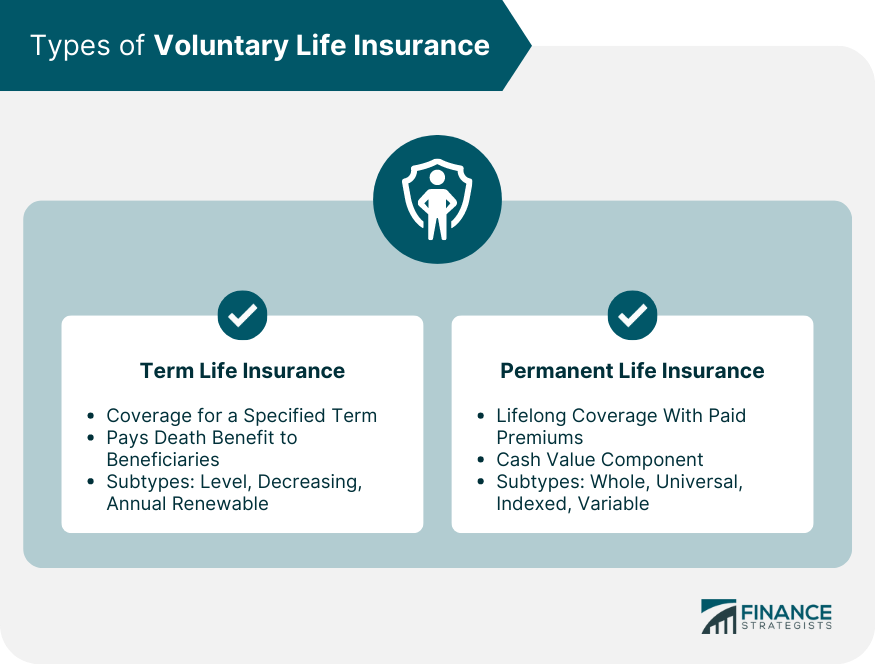

With level term insurance, the expense of the insurance coverage will stay the exact same (or potentially decrease if dividends are paid) over the term of your policy, typically 10 or two decades. Unlike irreversible life insurance policy, which never ever ends as long as you pay costs, a degree term life insurance policy plan will certainly finish at some factor in the future, usually at the end of the duration of your degree term.

Why Level Premium Term Life Insurance Could Be the Best Option?

As a result of this, many individuals utilize irreversible insurance policy as a secure monetary preparation device that can serve numerous needs. You might be able to transform some, or all, of your term insurance coverage during a set period, usually the first 10 years of your policy, without needing to re-qualify for coverage also if your health and wellness has actually changed.

As it does, you may want to include to your insurance policy protection in the future - Term life insurance level term. As this takes place, you may desire to at some point lower your death benefit or consider transforming your term insurance policy to an irreversible policy.

Long as you pay your premiums, you can rest easy recognizing that your loved ones will certainly obtain a fatality advantage if you die during the term. Lots of term policies permit you the ability to transform to permanent insurance coverage without having to take an additional wellness exam. This can permit you to make use of the fringe benefits of a long-term policy.

Degree term life insurance policy is among the simplest paths right into life insurance policy, we'll review the benefits and drawbacks to make sure that you can select a plan to fit your demands. Degree term life insurance policy is the most typical and basic form of term life. When you're seeking short-term life insurance policy strategies, level term life insurance policy is one path that you can go.

The application process for degree term life insurance policy is usually really straightforward. You'll fill in an application which contains basic personal details such as your name, age, etc in addition to a more detailed set of questions regarding your case history. Depending upon the plan you want, you may have to get involved in a medical checkup process.

The short solution is no., for instance, let you have the comfort of fatality benefits and can build up cash worth over time, meaning you'll have extra control over your benefits while you're to life.

What is Simplified Term Life Insurance? Comprehensive Guide

Motorcyclists are optional arrangements included to your policy that can offer you extra benefits and protections. Anything can take place over the training course of your life insurance coverage term, and you want to be ready for anything.

This cyclist supplies term life insurance policy on your youngsters via the ages of 18-25. There are circumstances where these benefits are constructed right into your policy, but they can also be available as a different addition that requires additional settlement. This motorcyclist gives an added death benefit to your beneficiary ought to you pass away as the outcome of an accident.

Latest Posts

Seniors Funeral Insurance

Insurance Policy To Cover Funeral Costs

Difference Between Life Insurance And Funeral Insurance