Featured

Table of Contents

Lots of entire, universal and variable life insurance coverage policies have a money worth part. With among those policies, the insurer deposits a section of your month-to-month premium settlements into a money worth account. This account earns passion or is invested, aiding it expand and give an extra considerable payout for your recipients.

With a level term life insurance policy policy, this is not the instance as there is no cash money value part. Consequently, your plan will not grow, and your fatality advantage will never ever increase, therefore limiting the payout your recipients will obtain. If you want a policy that offers a death advantage and builds money value, check into whole, universal or variable plans.

The 2nd your plan runs out, you'll no longer have life insurance policy protection. It's usually feasible to restore your plan, however you'll likely see your costs enhance considerably. This could provide concerns for retirees on a set income because it's an extra expense they might not be able to pay for. Level term and reducing life insurance policy offer comparable plans, with the major difference being the fatality advantage.

(EST).2. Online applications for the are readily available on the on the AMBA internet site; click the "Apply Now" blue box on the right-hand man side of the web page. NYSUT participants can additionally publish out an application if they would favor by clicking on the on the AMBA site; you will after that require to click on "Application Type" under "Kinds" on the right-hand man side of the web page.

What is the most popular Level Term Life Insurance Companies plan in 2024?

NYSUT participants registered in our Degree Term Life Insurance coverage Strategy have access to given at no added price. The NYSUT Member Perks Trust-endorsed Level Term Life Insurance Policy Plan is financed by Metropolitan Life Insurance policy Company and carried out by Organization Member Benefits Advisors. NYSUT Pupil Members are not eligible to join this program.

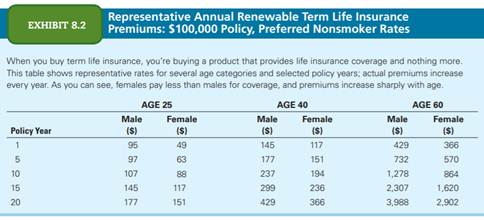

Term life insurance policy is an inexpensive and straightforward option for many individuals. You pay costs every month and the coverage lasts for the term length, which can be 10, 15, 20, 25 or 30 years. However what takes place to your premium as you age relies on the sort of term life insurance policy protection you acquire.

As long as you remain to pay your insurance policy costs monthly, you'll pay the exact same rate throughout the entire term size which, for numerous term policies, is generally 10, 15, 20, 25 or thirty years (Tax benefits of level term life insurance). When the term finishes, you can either pick to finish your life insurance policy coverage or renew your life insurance coverage plan, normally at a higher rate

Term Life Insurance With Fixed Premiums

As an example, a 35-year-old woman in superb health can purchase a 30-year, $500,000 Haven Term policy, provided by MassMutual starting at $29.15 monthly. Over the next three decades, while the policy is in area, the price of the protection will not transform over the term duration. Let's face it, the majority of us do not such as for our costs to expand gradually.

Your degree term price is figured out by a number of elements, a lot of which relate to your age and health and wellness. Other aspects include your specific term policy, insurance policy carrier, advantage quantity or payout. During the life insurance policy application procedure, you'll respond to inquiries regarding your health and wellness background, including any type of pre-existing problems like a critical ailment.

Remember that it's always extremely crucial to be truthful in the application process. Issuing the policy and paying its benefits relies on the applicant's evidence of insurability which is identified by your solution to the wellness questions in the application. A clinically underwritten term plan can secure an economical price for your coverage duration, whether that be 10, 15, 20, 25 or three decades, despite exactly how your health and wellness could alter throughout that time.

With this kind of level term insurance plan, you pay the exact same regular monthly costs, and your beneficiary or beneficiaries would obtain the very same benefit in the event of your death, for the whole coverage duration of the policy. So exactly how does life insurance coverage job in terms of expense? The expense of degree term life insurance policy will rely on your age and health in addition to the term length and coverage quantity you choose.

Who provides the best Affordable Level Term Life Insurance?

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Female$1,000,00030$43.3135 Male$500,00020$20.7235 Women$750,00020$23.1340 Male$600,00015$22.8440 Women$800,00015$27.72 Quote based on pricing for qualified Sanctuary Simple applicants in superb wellness. Pricing distinctions will differ based on ages, health status, protection amount and term size. Sanctuary Simple is presently not readily available in DE, ND, NY, and SD.Regardless of what protection you choose, what the plan's money worth is, or what the lump sum of the fatality advantage ends up being, comfort is amongst the most important advantages related to purchasing a life insurance plan.

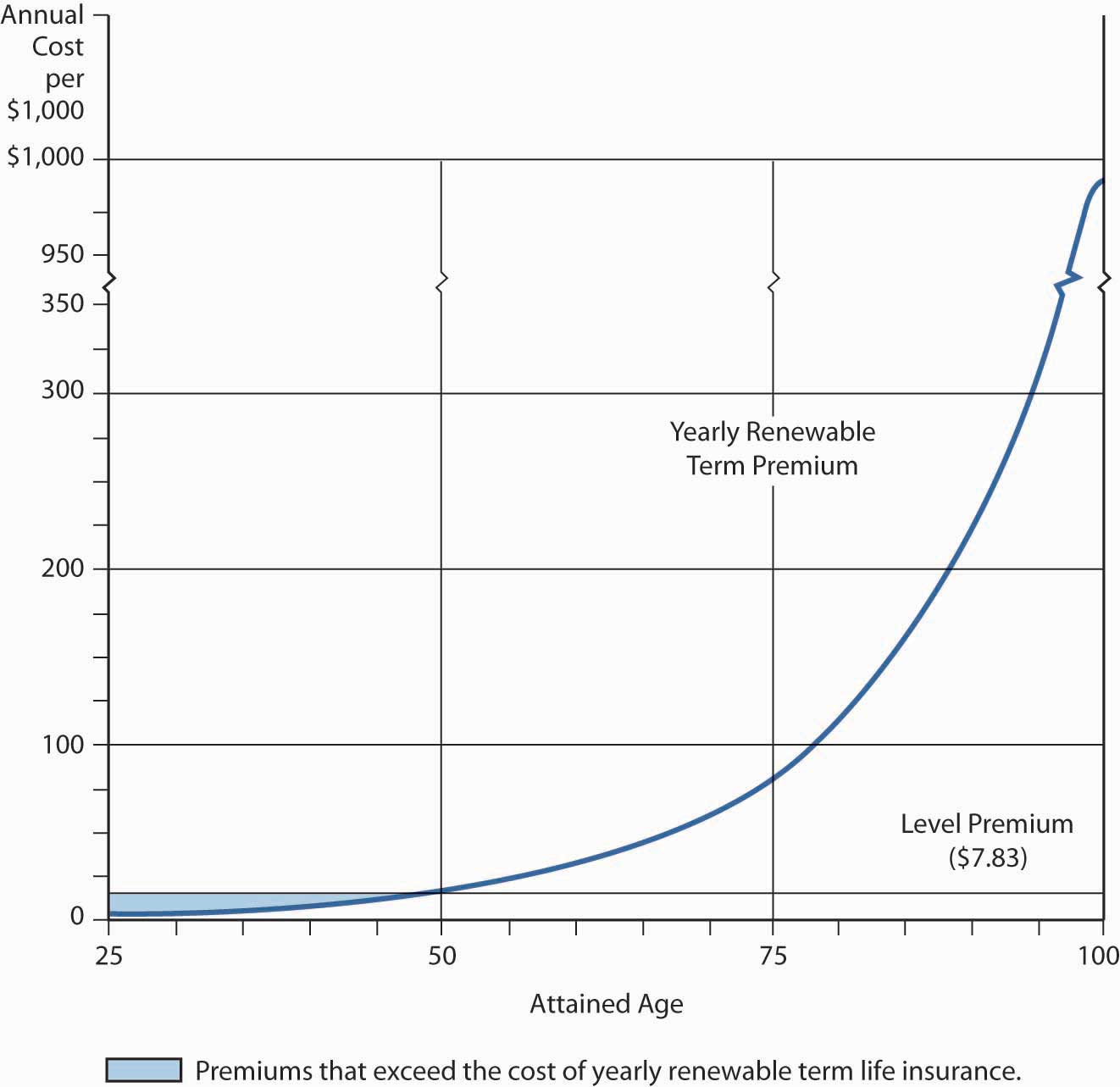

Why would certainly a person select a plan with a yearly renewable premium? It might be a choice to consider for somebody who requires coverage just momentarily. An individual that is in between jobs yet desires death advantage protection in place due to the fact that he or she has financial obligation or various other economic obligations may intend to consider an every year sustainable plan or something to hold them over till they start a new task that uses life insurance policy - Level term life insurance benefits.

You can generally renew the plan every year which offers you time to consider your options if you desire protection for longer. Know that those alternatives will certainly include paying more than you utilized to. As you get older, life insurance costs become significantly a lot more expensive. That's why it's handy to purchase the ideal quantity and length of protection when you first obtain life insurance, so you can have a low rate while you're young and healthy.

If you contribute important unsettled labor to the family, such as childcare, ask yourself what it may set you back to cover that caretaking job if you were no much longer there. Make certain you have that insurance coverage in place so that your family gets the life insurance coverage advantage that they require.

How do I get Level Term Life Insurance Vs Whole Life?

For that collection quantity of time, as long as you pay your costs, your price is secure and your beneficiaries are safeguarded. Does that mean you should always pick a 30-year term length? Not necessarily. In basic, a shorter term plan has a lower premium price than a longer plan, so it's smart to pick a term based on the projected length of your financial responsibilities.

These are very important variables to bear in mind if you were thinking of selecting an irreversible life insurance policy such as an entire life insurance coverage policy. Lots of life insurance policy policies offer you the choice to include life insurance bikers, assume added benefits, to your policy. Some life insurance coverage policies feature motorcyclists built-in to the price of costs, or motorcyclists may be readily available at a price, or have fees when exercised.

With term life insurance policy, the interaction that many people have with their life insurance coverage company is a monthly bill for 10 to three decades. You pay your regular monthly costs and hope your family members will never ever need to use it. For the group at Sanctuary Life, that seemed like a missed chance.

Latest Posts

Seniors Funeral Insurance

Insurance Policy To Cover Funeral Costs

Difference Between Life Insurance And Funeral Insurance