Featured

Table of Contents

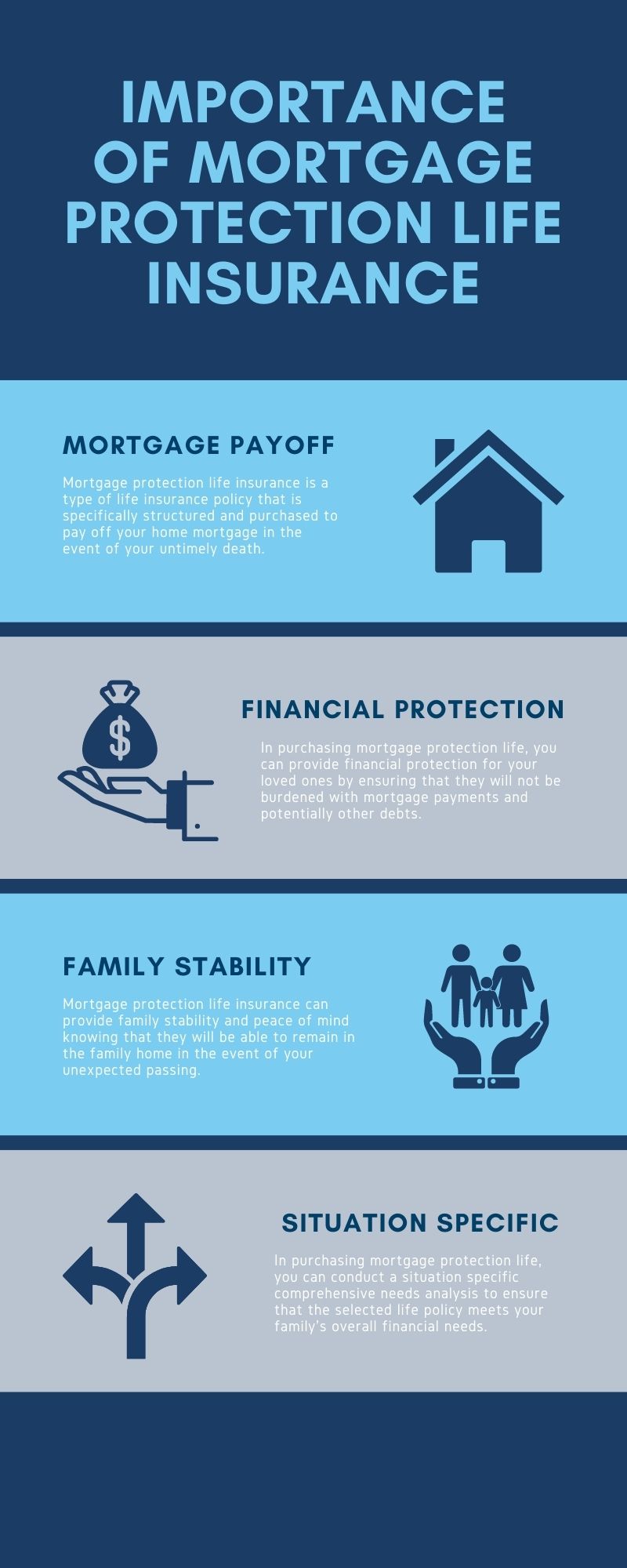

When individuals state "home mortgage security life insurance policy" they often tend to suggest this one. With this plan, your cover quantity reduces over time to reflect the reducing sum total amount you owe on your home loan.

To see if you might conserve money with lowering term life insurance coverage, request a callback from a LifeSearch specialist today. For more details click on this link or visit our mortgage security insurance coverage web page. Yes it does. The factor of home mortgage protection is to cover the price of your home loan if you're not about to pay it.

You can rest easy that if something happens to you your home mortgage will be paid. Life insurance and home loan security can be virtually one in the exact same.

The lump amount payment mosts likely to your loved ones, and they may pick not to clear the mortgage with it. It depends if you still intend to leave cash for liked ones when you pass away. If your home mortgage is clear, you're greatly debt-free, and have no financial dependents, life insurance policy or ailment cover might feel unneeded.

It depends on the worth of your home loan, your age, your health, household size, lifestyle, pastimes and conditions in general.

Life insurance policy exists to protect you. The ideal plan for you depends on where you are, what's going on at home, your health and wellness, your plans, your requirements and your budget plan.

Insurance Cover Mortgage

This suggests that all of the remaining mortgage at the time of the fatality can be fully repaid. The inexpensive is because of the payment and obligation to the insurer reducing in time (mortgage life insurance protection plan). In the very early years, when the death payment would be highest possible, you are normally much healthier and less most likely to pass away

The benefits are paid by the insurer to either the estate or to the beneficiaries of the person that has passed away. The 'estate' is every little thing they had and leave when they pass away. The 'recipients' are those qualified to a person's estate, whether a Will has been left or not.

They can after that remain to live in the home without further home loan settlements. Policies can also be set up in joint names and would certainly after that pay on the very first fatality throughout the home loan term. The advantage would certainly go right to the surviving partner, not the estate of the departed person.

Income Protection And Mortgage Payment Insurance

The plan would then pay out the sum guaranteed upon medical diagnosis of the plan owner suffering a severe health problem. These include heart assaults, cancer cells, a stroke, kidney failure, heart coronary bypass, coma, total irreversible handicap and a series of other serious conditions. Month-to-month premiums are normally repaired from outset for the life of the strategy.

The costs can be impacted by poor health, lifestyle aspects (e.g. smoking cigarettes or being overweight) and occupation or hobbies. The passion price to be charged on the mortgage is also vital. The strategies normally ensure to repay the impressive amount as long as a specific rates of interest is not surpassed throughout the life of the loan.

Home mortgage defense plans can provide easy defense in case of sudden death or crucial ailment for the superior home mortgage quantity. This is usually many people's largest monthly financial expenditure (what does mortgage insurance do). However, they must not be considered as ample protection for all of your conditions, and various other kinds of cover may likewise be needed.

We will examine your insurance coverage requires as part of the home loan advice procedure. We can after that make recommendations to meet your requirements and your allocate life cover.

Acquisition a term life insurance policy plan for a minimum of the amount of your mortgage. If you pass away during the "term" when the policy's in force, your loved ones receive the face value of the policy. They can make use of the proceeds to pay off the home mortgage. Profits that are often free of tax.

Mortgage Protection Life Insurance Over 60s

If your mortgage has a reduced rate of interest price, they may want to pay off high-interest debt card financial obligation and keep the lower-interest mortgage. Or they might want to pay for home upkeep and maintenance.

Locate out other manner ins which life insurance policy can help protect your and your family members.

Acceptance is ensured, no matter health if you are in between the ages of 18 and 69. No wellness inquiries or medical examinations. The cost effective regular monthly premiums will certainly never ever increase for any factor. Rates as low as $5.50 each month. For every year the Plan stays constantly effective, primary insured's Principal Benefit will immediately be boosted by 5% of the Preliminary Principal Advantage till the Principal Benefit amounts to 125% of the Preliminary Principal Benefit, or the key insured turns age 70, whichever is earlier. home loan security insurance.

Credit Mortgage Insurance

Globe Life is ranked A (Exceptional)**by A.M.

For most people, individuals life insurance offers insurance policy supplies much more durable Protection and can also be likewise to utilized off your mortgage in home loan event of occasion death. Home loan life insurance policy is created to cover the equilibrium on your mortgage if you die prior to paying it in complete. The payment from the plan reduces over time as your home loan equilibrium goes down.

The fatality benefit from an MPI goes right to your mortgage loan provider, not your family, so they wouldn't be able to utilize the payment for any kind of various other financial obligations or bills. A regular term life insurance coverage. mortgage insurance for seniors policy permits you to cover your home mortgage, plus any various other expenditures. There are less costly choices readily available.

Mortgage Insurance Life

The death advantage: Your MPI fatality advantage reduces as you repay your mortgage, while term life plans most commonly have a degree survivor benefit. This indicates that the coverage amount of term life insurance coverage remains the exact same for the whole period plan. Home loan security insurance policy is frequently perplexed with private mortgage insurance (PMI).

Entire life is dramatically extra costly than term life. "Term life is very essential for any individual they can have college loans, they may be wed and have youngsters, they may be solitary and have charge card car loans," Ruiz said. "Term life insurance makes good sense for many people, however some people desire both" term life and entire life coverage.

Otherwise, a term life insurance policy plan likely will supply even more versatility at a less costly price."There are people that do both [MPI and term life] due to the fact that they intend to see to it that their mortgage makes money off. It can also depend on who the beneficiaries are," Ruiz claimed." [It's inevitably] approximately what sort of protection and just how much [insurance coverage] you want - mis sold mortgage insurance."If you're uncertain which kind of life insurance policy is best for your scenario, talking to an independent broker can help.

illness, accident, etc. The only standard "exemption" is for suicide within the initial 13 months of establishing the plan. Like life insurance policy, mortgage defense is pretty uncomplicated. You select a quantity to shield (usually to match your continuous payments), a "wait period", and a "payment period". If you end up being damaged or ill and can not function, as soon as your wait period has actually finished, your insurer will certainly make month-to-month case settlements.

Latest Posts

Seniors Funeral Insurance

Insurance Policy To Cover Funeral Costs

Difference Between Life Insurance And Funeral Insurance